Get the free certificate of liability insurance

Show details

This document certifies that the policies of insurance listed have been issued to the named insured and outlines key details about the insurance coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of liability insurance

Edit your certificate of liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of liability insurance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of liability insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

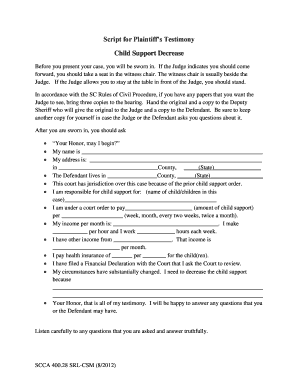

How to fill out certificate of liability insurance

How to fill out certificate of liability insurance

01

Obtain the standard form for the certificate of liability insurance from your insurance provider.

02

Fill in the name and address of the insured individual or business in the designated section.

03

Include the name and address of the insurance company issuing the policy.

04

List the types of coverage provided, such as general liability, professional liability, etc.

05

Specify the policy number associated with the insurance coverage.

06

Indicate the effective dates of the coverage, showing when the policy starts and ends.

07

Provide the details of any additional insured parties if applicable.

08

Sign and date the certificate to validate the information provided.

Who needs certificate of liability insurance?

01

Business owners who wish to protect their business from liability claims.

02

Contractors and subcontractors when working on projects that require proof of insurance.

03

Freelancers providing services that may expose them to legal claims.

04

Non-profit organizations hosting events that require insurance coverage.

05

Landlords requiring tenants to have liability coverage.

Fill

form

: Try Risk Free

People Also Ask about

Is a certificate of liability insurance the same as a declaration page?

If you need to show proof of auto insurance to the Department of Motor Vehicles or your lender, you may need a certificate of insurance. This document contains information similar to a declarations page but omits specific details that third parties don't need, such as your auto insurance premium.

How do I generate a certificate of insurance?

Call your broker, explain to them what the minimum coverage amount is and that you need proof of insurance. If your policy already meets the requirements, then the broker will contact your carrier to secure the COI.

What is the purpose of the certificate of liability insurance?

A certificate of liability insurance is a document proving that your business has general liability insurance or other types of liability coverage. It tells customers and potential business partners that your company is insured against claims of property damage, bodily injury or other harms.

What is the abbreviation for certificate of liability?

A certificate of liability insurance (COI), is a simple form issued by your insurance company. It includes the types of coverage, the issuing insurance company, your policy number, the named insured, the policy's effective dates, and the types and dollar amount of limits and deductibles.

How do I ask for a certificate of liability insurance?

Call your broker, explain to them what the minimum coverage amount is and that you need proof of insurance. If your policy already meets the requirements, then the broker will contact your carrier to secure the COI.

What is a certificate of liability insurance?

A certificate of liability insurance is a document that proves you have general liability insurance coverage. It is also called a general liability insurance certificate, proof of insurance or an 25 form. This document includes details about: Coverage amounts and limits. Your insurance company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificate of liability insurance?

A certificate of liability insurance is a document that verifies an individual or business holds a specific insurance policy, detailing coverage limits and types of insurance coverage they have.

Who is required to file certificate of liability insurance?

Typically, contractors, service providers, and businesses that work with clients, vendors, or government entities are required to file a certificate of liability insurance to demonstrate financial responsibility and protect against potential claims.

How to fill out certificate of liability insurance?

To fill out a certificate of liability insurance, you need to provide information including the insured's name and address, the insurance company details, the types of coverage, the policy numbers, effective dates, limits of liability, and any additional insured parties as required.

What is the purpose of certificate of liability insurance?

The purpose of a certificate of liability insurance is to provide proof of insurance coverage to clients or stakeholders, ensuring that the insured party can cover claims or damages incurred during the business operation.

What information must be reported on certificate of liability insurance?

The information that must be reported includes the name of the insured, the insurance company, policy numbers, types of coverage, coverage limits, the effective date of the policy, and any additional insureds, as well as a disclaimer about the nature of the certificate.

Fill out your certificate of liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.